What does an accountant do?

Accountants help individuals and businesses keep their financials in order. They can assist with small matters, such as lodging personal tax returns or larger matters, such as trust tax returns and business financials.

One size fits all?

In Australia, there are several types of accountants, each with different specialisations. Choosing an accountant with the appropriate qualifications and expertise that match your specific needs is important.

Some of the most recognised professional qualifications to look out for in your local accountant are:

- Association of Chartered Certified Accountants (ACCA)

- Certified Practicing Accountants (CPA) Australia

- Chartered Accountants (CA) Members of the Chartered Accountants Australia and New Zealand (CA ANZ)

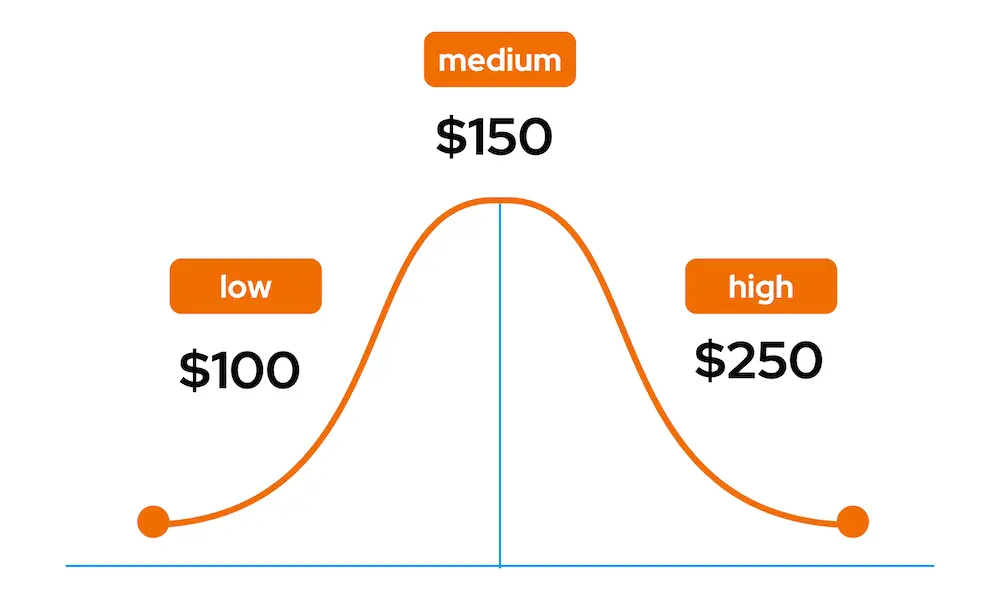

How much does an accountant in Brisbane cost?

In Brisbane, you can expect to hire an accountant for anywhere between $100 to $250 per hour. You will generally pay a higher fee if you require an accountant for complex business consultation or tax planning.

Many accountants in Brisbane offer fixed fees for their services, and others may provide an annual retainer for ongoing accounting and advice.

If you're looking for fixed prices, standard personal tax returns can start at around $90 and scale up to $350 depending on the complexity of the work, whereas business tax returns can range from $100 to $2000, depending on the business's structure and size.

Bookkeeping is the cheapest per hour, ranging from $40 to $90.

Personal tax returns

When completing your yearly personal tax returns, aim to book at least 3-4 months before June 30th. This will give you some time to do some pre-tax planning to see what deductions you can claim before the financial year ends.

Your new tax accountant will need a few things to get up to speed. Ensure you have your previous year's tax return, bank statements and expense receipts handy. Your new accountant may also send you an authority to act form, which gives them the authority to act as an agent on your behalf when dealing with the ATO. Businesses may also need to nominate their new tax agent via the online ATO portal.

Bookkeeping

Hiring a bookkeeper can save you time and take the stress out of complex bank reconcialitions. They can help reconcile all of your business transactions so that your books are always current, up to date and have the necessary receipts uploaded to your accounting software or stored in your systems.

If you have employees, they can also help with payroll and superannuation obligations and manage your accounts payable and receivable.

Business accounting

If you haven't started your business yet, a business accountant can help you set up your business structure (e.g., company vs. sole trader vs. partnership) and advise on the different levels of personal liability that each structure entails.

They can also assist you in setting up your accounting software, such as Xero, Quickbooks, or MYOB. They can also ensure that these are optimised to feed information automatically from your bank to help save time and make your internal accounting processes more efficient.

Business accountants can also assist with quarterly BAS (business activity statement) and monthly IAS (instalment activity statement) lodgements, which may arise if you are registered for GST or have employees on the payroll.

Key financial statements produced by accountants for businesses

- Statement of Financial Position (Balance Sheet): This is a snapshot of a business's financial strength at a given time, consisting of assets, liabilities and equity.

- Income Statement (Profit and Loss): This is a snapshot of a business's profitability over a certain period, consisting of income and expenses, to derive a profit before-tax figure.

- Cash Flow Statement: This statement shows all a business's cash inflows and outflows to assist with cash management and liquidity planning.

Disclaimer: This information is general in nature. Please seek advice from a qualified tax or financial advisor who is familiar with your individual circumstances before making any financial decision.